Accounting Franchise - An Overview

Table of ContentsNot known Details About Accounting Franchise Not known Facts About Accounting FranchiseThe Only Guide to Accounting FranchiseSee This Report about Accounting FranchiseFascination About Accounting FranchiseNot known Facts About Accounting FranchiseRumored Buzz on Accounting Franchise

We also use specialized franchise business accountancy solutions consisting of supply monitoring, suggestion appropriation, nobility fee audits, and cash circulation analysis. We comprehend that tax obligation obligations play a crucial duty in the profitability of any type of franchise (Accounting Franchise). That's why we're always mindful of changes to Federal and State tax policies that could influence businesses in your sector, and we will certainly help you plan appropriately

The Buzz on Accounting Franchise

To make sure that your records are accurate, you ought to consistently resolve your financial institution statements with your audit records. Franchise business bookkeeping involves preparing a range of monetary records, such as profit and loss statements, equilibrium sheets, and cash money flow declarations.

As a franchise business proprietor, you will certainly have a variety of expenses to pay, such as rental fee, utilities, and supplies. It is important to track these settlements and make sure that they are made on schedule to avoid late fees and damage to your credit rating rating. If you have workers, you will certainly require to manage pay-roll and employee benefits, consisting of paying wages and withholding tax obligations.

Accounting Franchise for Dummies

If you are thinking about outsourcing your franchise business bookkeeping, it is essential to select a reliable and skilled company. You should also think about the charges and solutions provided by various companies and pick one that lines up with your budget and organization objectives. By collaborating with a professional bookkeeping solution, you can concentrate on running and growing your business, recognizing that your economic documents are in great hands.

Develop a graph of accounts that is tailored to your franchise organization. This ought to have areas for franchise business costs, royalties, pay-roll, stock, and various other expenses that are details to the franchise.

10 Easy Facts About Accounting Franchise Explained

The bookkeeping guidebook differs for each service based on the organization design and audit practices in each location (Accounting Franchise). Select accounting software application that is qualified of handling the particular demands of franchise bookkeeping.

Bookkeeping software application most used in the United States market for small and medium-sized services: copyright OnlineDeskeraFreshBooksPatriotSageWaveXeroZoho bookssource:. Offer training to franchisees on how to make use of the bookkeeping software application and follow the bookkeeping procedures.

Things about Accounting Franchise

With automation devices, you can click to investigate enter data into your economic systems rapidly and properly. This saves time that would certainly have been invested going into information by hand. Automated information entry systems additionally ensure that all deals are taped appropriately. This makes financial procedures much more precise and easier to monitor.

It assists franchisees to start and manage their services more properly than when they would have started without the franchising contract. The licensed accountants supervise the organization's normal monetary operations and give valuable suggestions checking out money operations.

The accounting professional will certainly not be a responsibility to your firm, but instead, they will be a beneficial asset if you choose one of the most enlightened accountant. Disclosure legislations require the offering program to include the franchisors' financial declarations. These economic declarations consist of the equilibrium sheet, an audited revenue and loss account, and so forth.

Some Known Facts About Accounting Franchise.

The accountancy specialists aid in preparing these files and divulging them to the franchisor when required. Besides preparing the reports, the accountancy specialists clarify the financial records to the company's different stakeholders and clear up the papers' details. why not try this out Every state requires the services to file their income tax return, and the franchisees are not excused.

The updates need to be error-free and precise, and that's why it's critical to have an accountant. For prompt updates and renewals, the account utilizes a suggestion system to ensure that yearly audits are promptly done to stay clear of delay restoring the franchise registration. The accounting professional may additionally help the franchisor in picking a time during the year when it will certainly be convenient to make the yearly filing.

It is the function of an accountant via the interior controls to avoid and identify the mistakes. Automation of procedures and controls and proper review degrees can prevent mistakes from entering right into the accounting system that might harm a business's reputation. Resources budgeting is a bookkeeping concept that business monetary decision-makers utilize to determine which jobs they should pursue.

A Biased View of Accounting Franchise

It supplies a means of examining and gauging a job's expense throughout the life of the task. Accounting Franchise. It is likewise useful when analyzing and rating the worth of jobs or financial investments that call for a big resources. A great accounting professional can assist in the resources budgeting evaluation to assist you secure your properties

It is a method that works find out this here to align the real worth in arrangement with the established standards. It ensures that the expenditure sustained on production must not go past the established cost. Cost control entails a chain of numerous tasks that starts with preparing the budget in regard to production.

The duty of an accountant in a franchise procedure can not be underestimated. The professional makes sure that you continue to be tax obligation certified; you observe your economic commitments, and that's every monetary aspect fine. Locate a trusted accounting professional expert to hire in your organization today and see a distinction in your company.

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Jenna Jameson Then & Now!

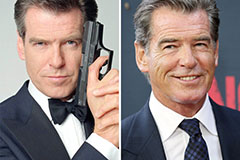

Jenna Jameson Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!